When it comes to keeping organized, staying on budget and saving money, great accounting software for small business can go a long way. It can allow you to monitor expenses and labor costs, manage invoices, follow up with payments and even help you handle payroll and HR administration. In the end, if your accounting software is really comprehensive, it could even eliminate the need for an accountant or bookkeeper—yet another cost savings for you.

However, the market is flooded with accounting software offerings. There is systems-based software, cloud-based software and even apps for your mobile phone. Which one should you choose?

Two of the most popular options for small businesses today are FreshBooks and Xero. These two solutions offer clients easy management of a variety of accounting and A/R-related tasks. They cover most important functions, from time tracking and expense reporting to recurring payments and automatic invoicing. However, each differs in pricing, setup, functionality or overall security. To help you decide which solution is best for your company, we’ve pulled together this handy comparison guide. Read on to see if FreshBooks or Xero is a better fit for your business.

FreshBooks vs. Xero: The Basics

FreshBooks is a cloud-based accounting solution, meaning it’s based in a virtual environment that can be accessed from anywhere you have a Wi-Fi connection. That means you can get to it via your mobile phone, laptop, digital tablet, or a variety of other ways. In addition to offering billing, invoicing and expense management, FreshBooks also offers time tracking and team timesheets to better enable collaborative projects. Users can even track time on the go, when work is required after hours or outside the office. FreshBooks bills itself as the No. 1 cloud accounting solution for small business owners, stating, “You’ll spend less time billing, and more time getting down to business.”

Xeo is a web-based accounting software for small business and accountants/bookkeepers. To access it, you’ll need a web-enabled device, or you can download the program’s free applications for iOS, Android, BlackBerry and more. On the small business side, Xero affords clients a convenient and centralized dashboard where they can view real-time financial details and see charts and graphs of costs and payments. They can also create reports and keep track of invoices and accounts. In addition, clients can invite other users to see and contribute to their financial management.

For accountants, bookkeepers and other financial representatives, Xero can offer a solution for managing multiple clients. It can also help connect financial advisors with other Xero clients who may need their guidance.

FreshBooks vs. Xero: Setup Comparison

Both FreshBooks and Xero are fairly easy to set up. Neither requires you to sign a contract, and neither asks for a setup or installation fee. Additionally, both offer you a free trial period, so you can get a feel for the program before committing any funds to it.

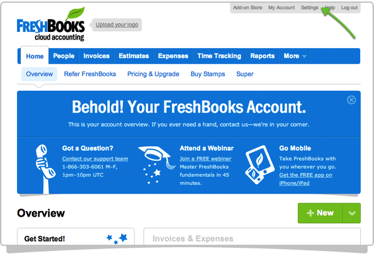

With FreshBooks, once you sign in for the first time, you’re shown a how-to video that explains creating your first invoice. From there, you view your dashboard, where you can add invoices, track expenses, connect bank accounts and more. It’s all done in a web browser—or through a FreshBooks mobile app—easily and quickly. If there’s any confusion, FreshBooks also offers a number of explanatory videos and webinars.

FreshBooks shows you a video upon first login that explains how to create your first invoice.

Once you’ve viewed the video, you’re taken to your main account overview. Here, you can add invoices, users, expenses, bank feeds and more.

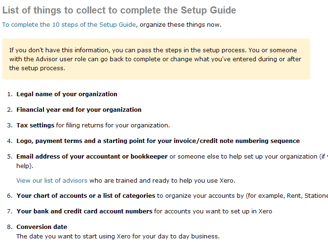

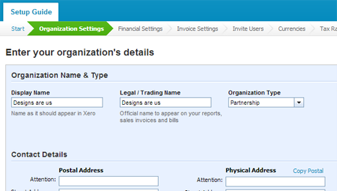

When you sign up for Xero, from the moment you log in, you’re taken through a step-by-step setup guide. You’ll import data from previous software, input bank details, invite users, set invoice preferences and more. To help you save time, Xero also provides a list outlining the information needed for setup. Once you’ve completed this, you can view videos covering topics such as banking, sales reporting, user roles and more, or you can go to your dashboard to view real-time data.

Xero provides a list detailing what information to have on hand during setup.

Xero takes you through a step-by-step guide to set up your account.

FreshBooks vs. Xero: Functionality Comparison

FreshBooks and Xero have a number of features and functions in common. Both offer online invoicing and online payments, both let you monitor bank accounts and real-time financial data, and both allow you to create reports, track expenses and follow up on overdue payments. But the two solutions are not entirely the same. Each offers a few functionalities that differ slightly or provide added value over their counterpart.

Xero, for example, turns your financial data into graphs and visual representations to give you a clearer view of your overall financial picture—something not provided by FreshBooks. Xero also allows you to set a watchlist so you can monitor certain accounts that need specialized attention.

Xero gives you the ability to see your information in graphical form.

Other unique features of Xero include:

- Limitless users so you can invite anyone on your team to view, interact with and collaborate on your finances in real time. You can also control what each individual user has access to and is able to see.

- Online bank reconciliation, allowing you to ensure all costs and charges are accounted for.

- Customized invoices so you can brand documents to your liking. (FreshBooks offers this, but it comes at an added cost.)

- Sales tax reporting, giving you and your financial representatives the insight you need going into tax season.

- Multiple currencies and exchange rates so you can do business with anyone in the world, no matter what form of money they use.

- Depreciation calculations, allowing you to monitor depreciating value against your fixed assets.

- An accountant/bookkeeper-specific solution, designed for financial representatives with their own client base.

Xero also offers free software updates (typically every three to six weeks), PayPal and payment gateway integration, double-ledger accounting, credit card and accounting monitoring, return/credit management and invoice status monitoring, so you can see when a client has opened or viewed your invoice.

Xero works seamlessly with a number of add-on solutions as well, including ones that manage inventory, benefits, human resources, payroll, quoting/estimates, customer relationship management (CRM) and point-of-sale devices. Xero even offers a FreshBooks add-on, so if you ever want to switch solutions or combine the power of both Xero and FreshBooks, you can do so smoothly and easily.

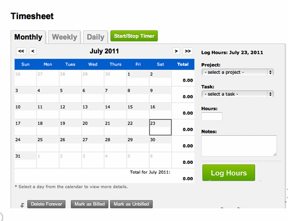

With FreshBooks, the major functionality difference is the time tracking feature. FreshBooks allows your team to track time on their computer, phone, tablet or wherever they’re connecting to the FreshBooks cloud. This allows you to track project spend, monitor unbilled time and more. You can even assign individual rates per project and generate per-project reports.

FreshBooks allows you and your team to track time.

Other features unique to FreshBooks include:

- Profit and loss monitoring so you can see how your company is performing as a whole.

- Account aging, giving you a full picture of the health of your accounts.

- Late payment reminders, alerting your clients via email or snail mail when they’re overdue on an invoice.

- Estimate creation, allowing you to automatically convert estimates into invoices once they’re approved.

- Automatic late payment fees on overdue accounts.

- Receipt attachments so you can easily upload expense receipts and attach them to your feeds.

FreshBooks also offers recurring invoicing, auto payments, expense tracking, rebilling, reporting, invoice monitoring and custom client portals, so your clients can view their account history and current invoices. Add-ons for FreshBooks allow you to integrate with PayPal and other payment gateways, perform project management tasks, offer client support, enable e-signatures and more.

FreshBooks vs. Xero: Price Comparison

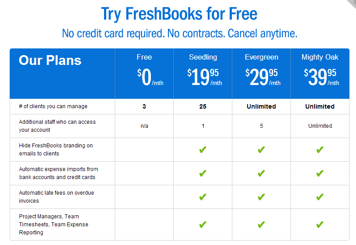

FreshBooks and Xero are both subscription-based and require a monthly payment. With FreshBooks, you have the option of choosing a free subscription, although your features will be limited and you will only be able to manage up to three accounts.

Other FreshBooks pricing options are: $19.95 per month for 25 accounts and one additional user, $29.95 for unlimited accounts and 5 additional users, and $39.95 for unlimited accounts and unlimited users. Each paid package offers the ability to hide FreshBooks branding on invoices, automated expense reporting, automatic late fees on overdue invoices, timesheets, team expense reporting and more.

FreshBooks’ pricing schedule

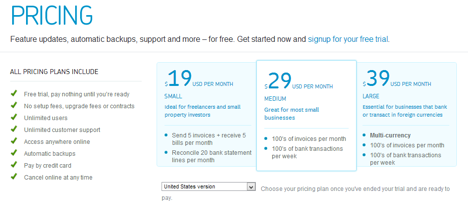

Xero has no free subscription and offers a similar three-tiered pricing schedule. For $19 per month, clients can send five invoices, receive five bills and reconcile 20 bank statement lines. For $29, they can send hundreds of invoices per month and reconcile hundreds of bank transactions per week. For $39, they can use multiple currencies, send hundreds of invoices and reconcile hundreds of bank transactions.

Xero’s pricing schedule

FreshBooks vs. Xero: Security Comparison

Of course, security is a major concern when choosing an accounting solution. You need to know that your financial data, as well as that of your clients, is safe from harm. Thankfully, both Xero and FreshBooks take security very seriously. Both solutions have a wide array of safeguards in place to ensure your info isn’t vulnerable to hacking, attack or data loss.

For instance, Xero and FreshBooks both offer redundant servers and data centers so, in the event power is lost or a server goes down, there is always another way to reach your data. Additionally, both solutions offer free backups. FreshBooks backs up all accounts nightly, while Xero runs database backups every 10 minutes.

The two programs both employ Secure Sockets Layer (SSL), firewalls, encryption and vulnerability scanning. Xero even undergoes third-party audits and inspections to ensure clients’ safety. Both Xero and FreshBooks offer physical security as well. Housed in facilities with biometric access, 24/7 surveillance systems and redundant power feeds, data is vigilantly protected against unauthorized access.

FreshBooks vs. Xero: Client Support Comparison

FreshBooks and Xero both offer unlimited client support to their clients. The differences between the two can be seen in the availability of this support and how it’s obtained. On the one hand, FreshBooks offers client support via a phone line open from 9 a.m. to 6 p.m. EST Monday through Friday. FreshBooks also offers online FAQs and videos to help clients when support is unavailable. On the other hand, Xero offers 24/7 support via email. They also provide a comprehensive business help center, various guides and how-tos, and online training courses and webinars for more advanced training. In addition, Xero answers questions through Twitter, Facebook and LinkedIn.

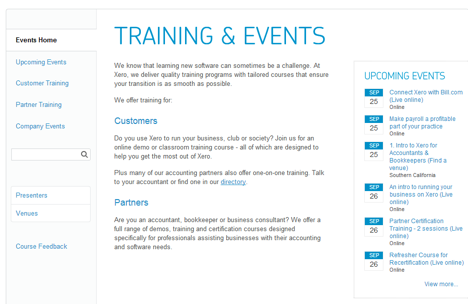

In addition to 24/7 support, Xero offers training and events for users who want more advanced skills.

In Conclusion

After an in-depth analysis, it seems that both FreshBooks and Xero are viable options if you need A/R support or a full-scale accounting solution for your business. In addition, since both offer free trials, there’s no risk in trying either one.

Best of all, both programs offer their own application programming interfaces (APIs) so they can easily be integrated into your existing systems or incorporated into any customized software you wish to create. In fact, Xeo can help with this. If you’re looking for custom software that improves your business and integrates seamlessly with your accounting software, contact the Xeo team today through our online form. We’ll be happy to help.